marin county property tax exemptions

To qualify for a Measure A senior exemption you must be 65 years of age or older by December 31 of the tax year own and occupy your single-family residence located in the. Learn About Your Senior Exemptions.

Property Tax Bills Arriving In Mailboxes Soon

By applying for the Homeowners exemption you can save approximately 70 on your property taxes each year.

. If you are over the age of 65 and use the property as your principal residence you may be eligible for a parcel tax exemption. The individual districts administer and grant these exemptions. Marin County has one of the highest median property taxes in the United States and is ranked 26th of the 3143 counties in order of median property taxes.

Low-Income Senior Exemption Application Measure A. By applying for the Homeowners exemption you can save approximately. The homeowners exemption reduces the annual property tax bill for a qualified homeowner by at least 70.

Marin Countys Property Tax Exemption webpage has a full list of the agencies whose taxes are collected via property tax bills and may offer discountsexemptions. In-depth Marin County CA Property Tax Information. -To qualify for a contiguous exemption of the 36 parcel tax any parcel of land developed or undeveloped wholly or partially located within the Special Tax Zone No.

Your property taxes would remain at 3500 instead of the new rate of about 12500 per year for a 1M house. Marin Countys Property Tax Exemption webpage has a full list of the agencies whose taxes are collected via property tax bills and may offer discountsexemptions. Marin Countys Property Tax Exemption webpage has a lot of the information you need for most but not all of the taxes and fees that could impact you.

If you are a person with a disability and require an accommodation to participate in a. 13 rows Marin County Property Tax Exemptions If you meet certain requirements involving. The homeowners exemption reduces the annual property tax bill for a qualified homeowner by at least 70.

These are deducted from the assessed value to give. Additionally parcels which are classified by County Assessor Use Codes 15 and 53 90 are also exempt from this tax. If you are over the age of 65 and use the property as your principal residence you may be eligible for a parcel tax exemption.

2 of the Marin County. This would result in a savings of approximately 70 per year on your property tax bill. This would result in a savings of approximately 70 per year on your property tax bill.

Marin Emergency Radio Authority - 29 Parcel Tax This application serves as a request for a Measure A low-income senior exemption. Marin Countys Property Tax Exemption webpage has a lot of the information you need for most but not all of the taxes and fees that could impact you. These exemptions include churches non-profits and local governments.

Please contact the districts directly at the phone numbers located. If you enter your parcel. All homeowners in Marin County may be eligible for a 7000 exemption on the assessed value of their primary home.

For residential real estate one of two methods is normally employed when contesting. Exemptions are available in Marin County which may lower the propertys tax bill. All homeowners in Marin County may be eligible for a 7000 exemption on the assessed value of their primary home.

This collection of links contains useful information about taxes and assessments and services available in the County of Marin. Tax exemptions especially have been a rich area for adding new ones and restoring any under scrutiny. Subscribe to receive a property tax due date email notification Change Property Tax Mailing Address.

The Assessment Appeals Board.

Marin Wildfire Prevention Authority Measure C Myparceltax

Marin County Mails Property Tax Bills Seeking 1 26b

First Installment Of Property Taxes Due Dec 10 In Marin County San Rafael Ca Patch

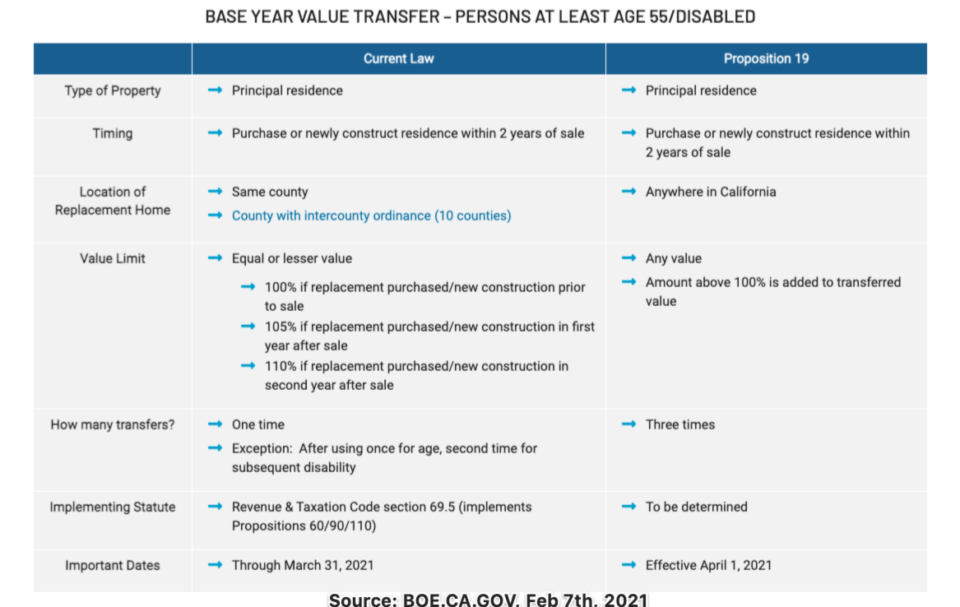

Prop 19 And Property Taxes In California Marc Lyman

About Proposition 19 2020 Ccsf Office Of Assessor Recorder

Pin On Real Estate Information

Transfer Tax In Marin County California Who Pays What

Cook County Assessor S Office What Is A Certificate Of Error Facebook

Cook County Assessor S Office How To File An Online Appeal Facebook

Title Wave New England Marine Title Newsletter Marine Documentation Services